Is Social Media Really Just a Young Person's Game?

Tuesday January 23, 2024 | Alexandra Romjue, Data Analyst, Senior

When trying to gain the attention of new customers at your institution or engage your current customers, social media may be the way to go. While this is not a surprise, especially in today’s world of posts, tweets, and stories, what is important to understand is that social media is influential among all generations, not just Millennials and Gen Z.

In a recent study conducted by Raddon Research Insights, we took a deep dive into how consumers react to marketing and advertising in general, and for financial institutions specifically.

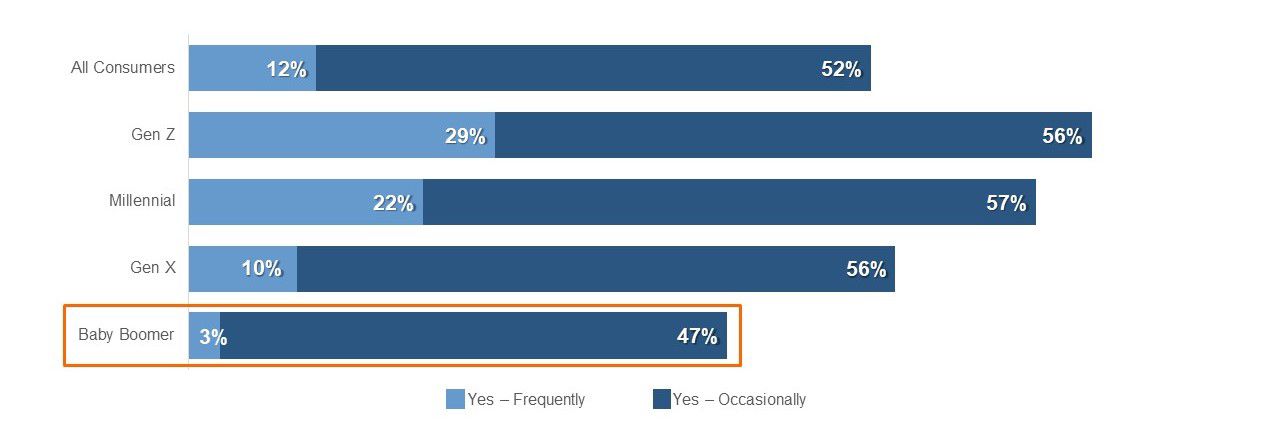

Figure 1: Percentage of Social Media Ad Influence

When It Comes to Advertising, Social Media Is the New Commercial

Source: “Marketing to the Modern Consumer,” Raddon Research Insights, 2023. Q: Do you feel that social media ads have influenced your purchasing decisions in the past? (n=1,532)

Regardless of whether we are talking about financial institutions or purchase decisions as a whole, social media is influential when it comes to decision-making. Taking all ages into account, more than half of consumers have found a social media ad to be at least somewhat convincing when it came to making a purchase. This percentage increases as the generational segment trends younger, which is not surprising, but we still found that over a quarter of Baby Boomers are influenced by ads they see on social media.

This goes to show that, while it is imperative to use channels such as social media to attract and obtain a younger consumer base in the interest of creating customers for life, it is also important to generate campaigns for consumers of all ages. Banking products and financial needs are for everyone, not just younger generations. Therefore, your products and services must serve people of all ages, though you may have to design your social media posts in a way that is compelling to the specific audience you are trying to reach.

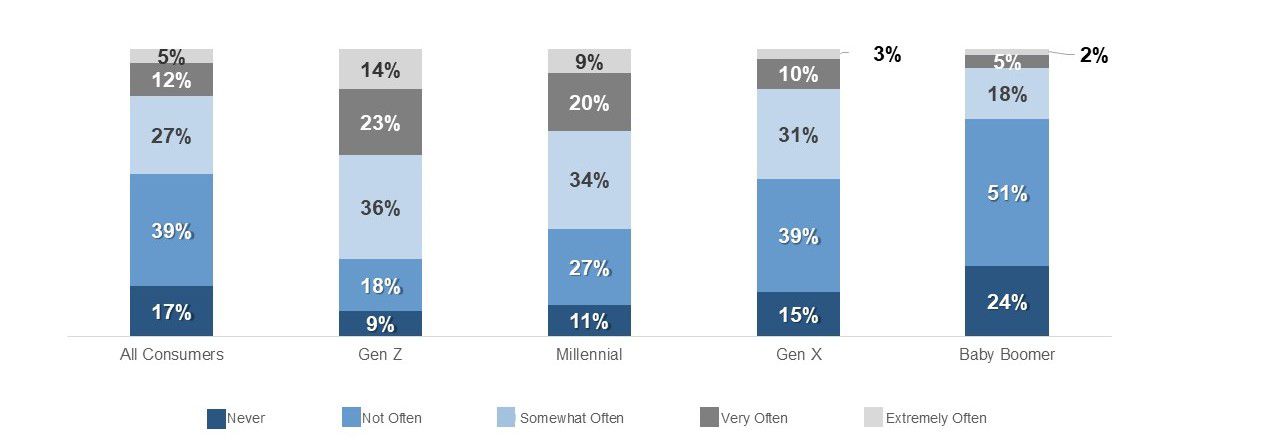

Figure 2: Frequency of Clicking on Social Media Ads to Learn More

Baby Boomers Are Taking an Interest in Advertisements Online

Source: “Marketing to the Modern Consumer,” Raddon Research Insights, 2023. Q: Have you ever clicked on an ad on social media to learn more or make a purchase? (n=1,532)

Our research finds it is important to keep Gen X and Baby Boomers part of the conversation on social media. In fact, as shown in Figure 2, 50% of Baby Boomers have at least clicked on an ad they saw on social media. Whether occasionally or frequently, there is no question that social media ads are gaining some attention beyond just Gen Z and Millennials. Gen X goes beyond 50%, with two-thirds of them clicking on an ad they saw on social media. And when you have an ad that stands out enough to be clicked on, you are more likely to see an increase in whatever you are selling.

When creating social media ads or campaigns, it’s important to consider who you are targeting as an audience and to include all consumers in the financial conversation. While younger consumers may use social media more frequently, finances and the need for financial education follow us throughout our entire life. Retirement, IRAs, and special rates on deposits are topics that can create an engaged consumer in a different demographic than you are used to reaching on social media. Different products and services can be helpful for a variety of life stages, making it important to include all age groups and generations in your outreach.

Figure 3: Financial Advertisement Relevancy by Generation

Baby Boomers Are Feeling Left Out of the Conversation

Source: “Marketing to the Modern Consumer,” Raddon Research Insights, 2023. Q: How often do you find the advertisements from financial institutions are relevant to your needs? (n=1,532)

In fact, when looking at relevancy within generational segments, Baby Boomers and Gen X are not finding that ads from financial institutions are relevant to them and their needs. For instance, Figure 3 shows that Baby Boomers only find relevant financial institution ads about 25% of the time, compared to Gen Z’s 44%. Clearly, it is crucial to keep Gen X and Baby Boomer consumers part of the picture when advertising on social media.

So … Is Social Media Just a Young Person’s Game?

The answer to that is yes and no. Social media has been popular since the early 2000s and has engaged many young consumers. But while Gen Z are our digital natives and Millennials were introduced to social media early on, that does not mean that it is only designed for those generations. Social media is used by any and all consumers, regardless of age.

As a financial institution, you need to ask yourself how you can create a social media presence for all stages of life, not just Gen Z and Millennials. That way you can develop long-lasting relationships among all your consumers.

Want to ask us a question?

Interested in our services?

We’re here to help.

2900 Westside Parkway

Alpharetta, GA 30004

© 2025 Fiserv, Inc., or its affiliates.