Record Rate Sensitivity – the Deposit Dilemma

December 3, 2020 | Caroline Vahrenkamp

The twin storms of the pandemic and the falling rate environment have pushed millennials to seek higher deposit yields. This heightened rate sensitivity causes a dilemma for institutions seeking to retain deposits while managing margins.

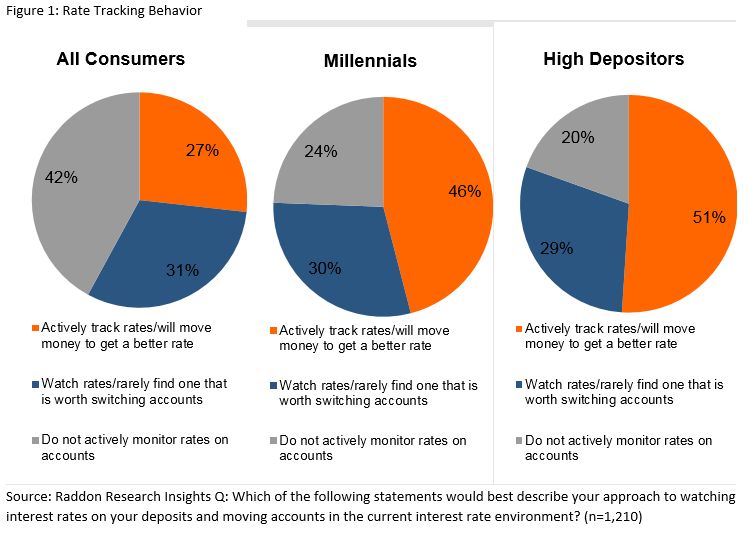

Recent years have shown a marked increase in rate sensitivity. The sudden pandemic and drop in rates have brought that sensitivity to a fever pitch. According to Raddon Research, in 2018, only 9 percent of consumers were actively tracking rates; in 2019, that percentage had grown to 16 percent. Now, in 2020, 27 percent of households say they actively track rates.

Two separate but slightly overlapping groups track rates more than any others: high depositors, who have at least $50,000 in deposits at all institutions (51 percent actively track), and millennials (46 percent). Raddon Research shows only 22 percent of millennials, representing 7 percent of all households, fall into the high depositor group. So for the most part, these are two very different rate-sensitive populations.

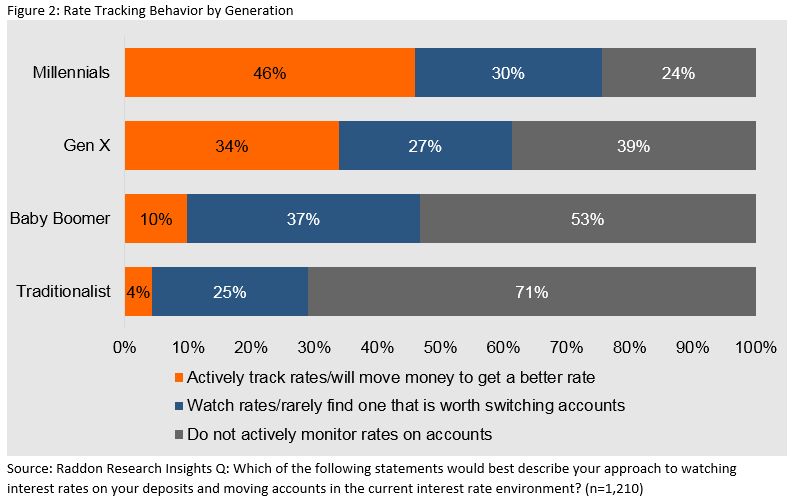

While logic would suggest that people with high deposits caring about rates would make sense, young people caring might not, unless one considers the rate environment that millennials, currently 21-40 years old, have experienced. For the bulk of their financial lives, millennials have experienced only low rates. In 2007, the last “high” rate environment when the Fed Funds rate was 5 percent, the average millennial was still in high school. When the only rates you have experienced are in the 0 percent to 2 percent range, small differences of 0.25 percent mean much more than if you remember 12 percent certificate rates.

To prove that point, 2020 Raddon research reveals that only 10 percent of baby boomers and 4 percent of traditionalists say that they actively track rates.

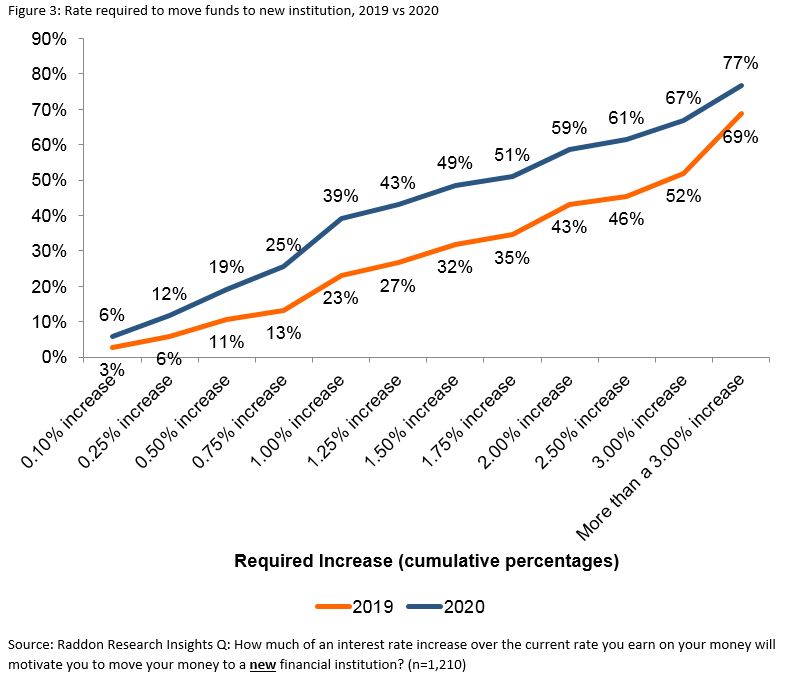

While in past years we’ve noted that many consumers would be unwilling to move their account to a new institution unless the rate offered was significantly higher, we now find that the additional rate sensitivity is making people far more willing to move than they had been.

Where a year ago only 23 percent said they would move to a new institution for a 1 percent increase in rate, 39 percent of consumers would make that move today, and nearly half (48 percent) would move to a new account at their current institution. Only 22 percent would not move for any rate increase, a percentage that was 31 percent a year ago and 42 percent in 2017.

When it comes to future behavior, however, the biggest predictor appears to be active rate tracking. Of active trackers, 71 percent have closed one account and opened another for a better yield, and 62 percent moved their money in the past two years.

Active trackers are much more willing to move for rate than others: 98 percent would move for some rate increase, including 68 percent who would move for an additional 100 basis points; whereas 30 percent of non-rate trackers would never move their funds for any rate increase.

Remember that millennials are far more likely to be tracking rates actively than any other segment.

As wealth transfers from older consumers to younger, community banks and credit unions particularly could be endangered by their lack of engagement with millennials, as described in Raddon’s recent study, The 2020 Challenge. In addition, a return to low rates paired with heightened sensitivity can make margins much more challenging to manage. Given these overwhelming threats, institutions should make attracting and retaining millennial deposit business a key long-term priority.

Millennial sensitivity and willingness to move is a significant threat to the standard deposit model, which relies on inertia among the bulk of the core deposit base. Only 18 percent of millennials use a term deposit account, and by balance, on average 88 percent of millennial deposit balances are in core accounts: checking, savings, and money market.

Ultimately, institutions may need to change their deposit pricing model – becoming more competitive on liquid accounts while being less competitive on term deposits, as those certificate accountholders seem to be less rate-sensitive.

Attracting millennials can be easy with a good rate; however, they can just as easily be attracted to move elsewhere, especially if the barriers to entry are low. With so many online accounts offering a seamless opening and funding experience, institutions stuck in antiquated processes may find themselves hard-pressed for funding.

For tactics and additional data and analysis, look for our forthcoming Raddon Research Insights study, Deposits Insights: Rise of the Millennial Saver.

Want to ask us a question?

Interested in our services?

We’re here to help.

2900 Westside Parkway

Alpharetta, GA 30004

© 2025 Fiserv, Inc., or its affiliates.