Characteristics of Your Most Unprofitable Households

Thursday, April 8, 2021 | Megan Cummins

By: Megan Cummins and Jan Trifts

In a recent Raddon Report article, Characteristics of Your Most Profitable Households, we discussed the importance of understanding what makes an accountholder profitable. In this report, we’ll discuss the characteristics of your unprofitable households and provide strategies for engaging them.

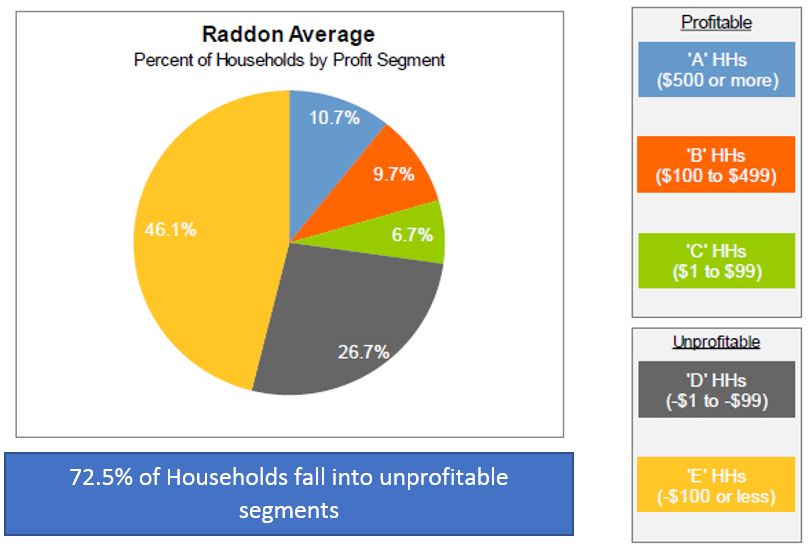

We will focus on two Raddon segments – the D and E retail households. Below we take a look at the Raddon averages for both profitable and unprofitable households.

In the past two years, the number of unprofitable households has increased by almost 8 percent from 64.8 percent. D households have increased by 2 percent, and E households by over 6 percent.

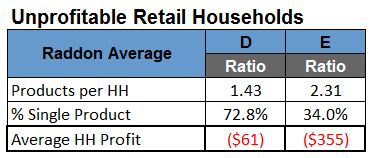

Unprofitable retail households are assigned to the D and E groups based on their annual net income contribution to the institution. D households cost the financial institution between $1 and $99, with the Raddon average at -$61. E households cost the financial institution at least $100, with the Raddon average at -$355.

Even though the E households are less profitable than the D households, they are more engaged accountholders. The table above shows the difference in the engagement levels, with 34 percent of the E households being single service versus 73 percent for the D households.

The questions to answer are: What is making these accountholders unprofitable? What is driving the difference in profitability? And how are the relationships different for the D and E households?

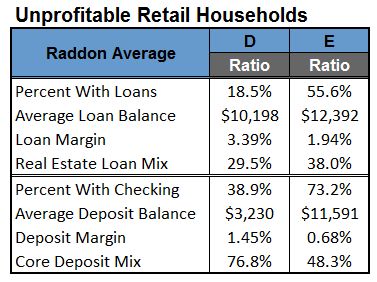

The chart above highlights the main differences between the D and E households. Although the loan average balances are similar, only 18.5 percent of D households have a loan, whereas 55.6 percent of E households have a loan. For E households, the loan margin is significantly lower due to the higher percentage of real estate loans. The lower deposit margins for the E households are being driven by the higher percentage of noncore deposits.

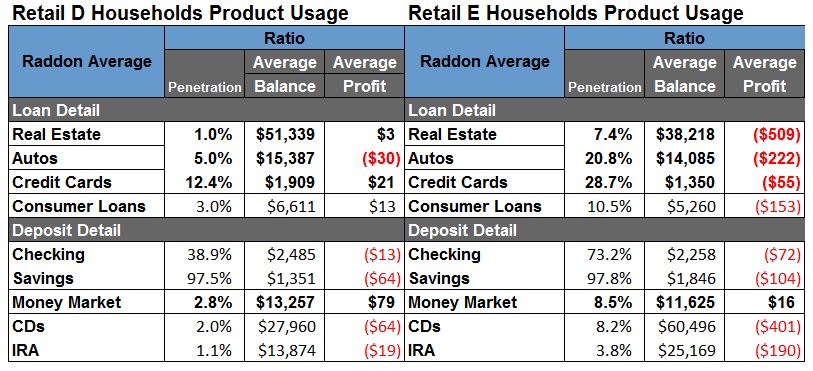

A detailed comparison of product usage for the D and E households reveals more.

The chart above shows the higher usage and balances in noncore deposits (CDs and IRAs) for the E households. On the loan side, the lower balances in real estate are driving that profit down for the E households. The typical Raddon average for credit cards is over $2,000. While E households do have credit cards, their average balance is lower. The average balance for autos is over $15,500, with new autos averaging about $22,000. As the chart details, for E households, this balance is much lower, indicating that the loans have probably been open for longer periods of time.

Do your unprofitable accountholders have the same product mix, or is it different? Focus first on the areas where the product and/or balance gap is the highest. Financial institutions need to develop strategies to identify the low-hanging fruit in these lower profitability groups.

Strategies for E Households

The higher levels of engagement with the E households makes them the first group to target. Strategies for E households should focus on activation of existing lines, core deposit product usage, review of noncore deposit pricing and asking for the next loan relationship.

- HELOC activation reminders throughout the year can be very successful at increasing line usage

- For autos, focus on those that have had an auto for at least 18 months and ask for that next auto loan

- Credit card campaigns need to focus on getting your card to the top of your accountholders’ mobile wallets for subscriptions and often-used services like video streaming, food delivery and transportation. The same type of promotions can be used for debit cards, as well

- E households have a checking account, but are they using it? Promote strategies to maintain active checking accounts

- Promoting your money market accounts versus CDs will help lower your cost of funds

- If rate premiums are important to some of your E households, ask for a certain amount of deposits to be in core dollars

- Given the recent influx of deposit dollars, review your pricing strategy

- Offer free credit report reviews to identify loans held at other financial institutions. You can also use your transaction information to identify accountholders making payments to other financial institutions

Strategies for D Households

The first strategy around D households should be to determine how long they have been a D household. Many institutions will take an “up or out” approach. Did these accountholders have an indirect loan that was paid off years ago? Do they realize they still have an account with your financial institution? Do they live within your branch network? Do they have any activity on their checking account?

If they live within your branch network, a reboarding effort would be the first step (especially if you can use a lower cost delivery channel). If reboarding efforts fail and the accountholders are not moving “up,” an “out” strategy might be the next step. Do you have fees in place to close out inactive accounts over time?

As you implement some or all of these strategies, be sure to measure your success. Accountholder engagement is so critical in this current environment of lower interest rates, thin margins, increasing loan losses and rising expenses. With consistency and tracking, you can begin to move the needle in the right direction.

Want to ask us a question?

Interested in our services?

We’re here to help.

2900 Westside Parkway

Alpharetta, GA 30004

© 2025 Fiserv, Inc., or its affiliates.